From Compliance to Competitive Advantage: The Business Case for ESG Investments

3 min reading

Operating with environmental and social responsibility is no longer optional. Environmental, Social, and Governance (ESG) considerations are rapidly becoming central to long-term business success. Companies that fail to integrate ESG into their operations may not only struggle to meet regulatory requirements but could also face severe competitive disadvantages. Businesses making no effort to operate with the environment in mind could risk losing 50% of their market share within the next five years.

ESG and the Risk of Inaction

Environmental responsibility is no longer just about compliance; it’s about survival. Consumers, investors, and regulators demand more transparency and accountability, and companies failing to deliver face growing risks. A lack of ESG effort can lead to accusations of greenwashing—where companies make false or exaggerated claims about their environmental efforts. This damages consumer trust, tarnishes brand reputation, and can cause market share to erode as more socially conscious competitors take the lead. Beyond reputation, companies that engage in greenwashing may also face legal repercussions, including costly lawsuits and penalties.

Companies must understand that simply saying the right things won’t cut it anymore. Forensic ESG scrutiny is becoming more sophisticated, making it increasingly difficult for businesses to maintain their reputations without taking genuine, measurable actions. Regulatory bodies, investors, and watchdog organisations are watching closely, ensuring that ESG commitments are met with tangible results.

ESG as a Value Driver: Five Ways ESG Creates Competitive Advantage

1. Access to Capital

Investors are increasingly prioritising ESG criteria in their decision-making. Companies that demonstrate a strong commitment to sustainability are more likely to attract investment, particularly as ESG funds continue to grow in prominence. By embedding ESG into the core of their operations, businesses can unlock new capital streams and appeal to socially conscious investors looking for long-term, sustainable growth.

2. Risk Mitigation

Companies that proactively address ESG issues are better positioned to mitigate risks associated with regulatory changes, market fluctuations, and environmental crises. By investing in sustainability now, businesses can avoid potential regulatory penalties, operational disruptions, and reputational damage down the line. Additionally, aligning with ESG frameworks helps companies adapt to future legislative changes, such as tighter carbon emissions standards or mandatory social impact reporting.

3. Enhanced Consumer Trust and Loyalty

Today’s consumers care about where they spend their money, with sustainability and ethical practices playing a significant role in purchasing decisions. Businesses with strong ESG credentials can build greater trust with consumers and foster loyalty over time. Companies seen as environmental or social leaders can also benefit from premium pricing and increased market share as more consumers prioritise values-aligned brands.

4. Operational Efficiency and Cost Savings

Contrary to the misconception that sustainability is a costly venture, companies that integrate ESG often find that it leads to operational efficiencies and significant cost savings. Reducing energy consumption, minimising waste, and optimising resource usage can all result in lower operating costs. Businesses implementing energy efficiency initiatives can save between 15% and 80% on energy consumption, which directly impacts the bottom line.

5. Attracting and Retaining Talent

Employees, like consumers, are becoming more value-driven. Companies that demonstrate a commitment to ESG can attract top talent and maintain a more motivated workforce. Employees want to work for organisations that align with their values, and they are more likely to stay loyal to companies that are committed to making a positive impact on society and the environment. By investing in ESG, businesses can build a more engaged, productive, and innovative team.

The Scrutiny of ESG Claims

The rise of forensic ESG scrutiny means that businesses must back up their words with action. Greenwashing has become a high-profile risk, and companies making hollow claims about sustainability face growing consequences. Investors, consumers, and regulatory bodies have become savvier in detecting insincere efforts, and the penalties—both reputational and financial—are steep. Businesses that fail to meet their sustainability commitments risk losing credibility and market share.

For companies navigating this landscape, it’s crucial to understand that the scrutiny won’t lessen—it will intensify. Stakeholders are no longer satisfied with vague promises. They demand quantifiable results. As ESG standards become more stringent, the companies that thrive will be those that genuinely integrate ESG into every facet of their operations.

Doing the Right Thing: From Compliance to Leadership

While compliance is essential, ESG is about more than just meeting minimum standards. It’s about leading the way in environmental and social responsibility. Businesses that genuinely commit to ESG practices aren’t just avoiding risks—they’re unlocking new opportunities for growth. They’re driving innovation, attracting capital, retaining talent, and, ultimately, positioning themselves as leaders in a future that values sustainability and ethics.

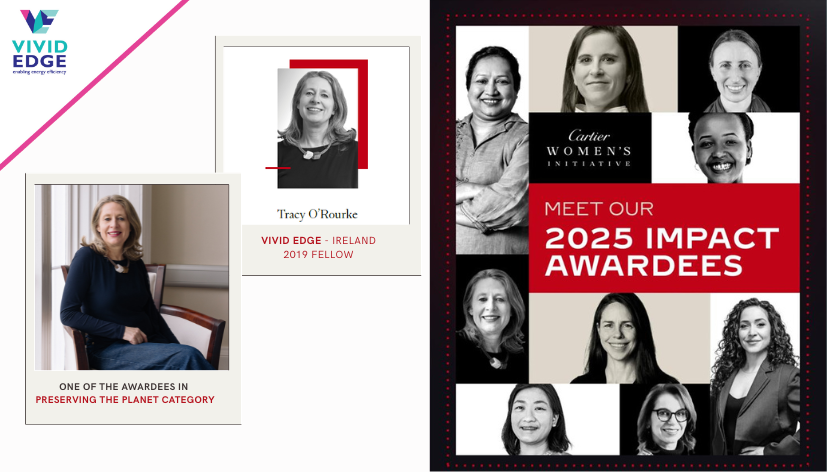

With the help of Vivid Edge, businesses can accelerate their ESG journey and stay ahead of the curve. Vivid Edge provides the expertise needed to assess, implement, and manage sustainability initiatives, helping companies transition from compliance to competitive advantage. By doing the right thing—not just saying it—companies can safeguard their future, protect their reputation, and secure long-term success.

The business case for ESG investments is clear. Companies that fail to act face significant risks, including reputational damage, loss of consumer trust, and declining market share. However, businesses that embrace ESG as a value driver will mitigate these risks and unlock opportunities for growth, efficiency, and competitive advantage. As forensic scrutiny of ESG claims intensifies, it’s no longer enough to make promises—businesses must take measurable, meaningful actions. With the right approach, ESG can be a powerful driver of business success in the years to come.